TITLE OF INVENTION: METHODS, SYSTEMS AND COMPUTER PROGRAM PRODUCTS TO FACILITATE THE FORMATION AND TRADING OF DERIVATIVES CONTRACTS

BACKGROUND OF THE INVENTION

Financial derivatives, also known as contingent claims, are special types of contracts used by financial risk managers to hedge against the fluctuations of more basic imdorlymgs throughout time Throughout this document, the term underlying is defined as m PAS Statement 133 appendix A, paragraph 57, a In the recent years, derivatives have become increasingly important m the field of finance According to the latest report from the Bank for Internationals Settlements (BIS) on Derivatives activity, the notional amount on all derivatives positions hold by trading institutions stood at over 187 trillion dollars at the end of year 2000 (this value represents the sum of contracts traded through exchanges and over the counter) The financial industry has responded to this growth in the derivatives market by developing new methods and systems to price and hedge derivatives contracts and to facilitate trading m derivatives contracts

The following problems arc known to limit the accuracy in present approaches to price and hedge derivatives contracts, hence the ability to most efficiently and effectively trade derivatives contracts

a) a) The current approaches to valuing derivatives make the assumption that hedging is done in continuous time, while m practice, participants hedge their positions m discrete time increments Therefore, the existing approaches used m the financial industry or suggested by the academic community do not accurately account for this inherent discrepancy and arc limited accuracy when applied to real markets and the pricing of derivatives b) Current approaches to vahung derivatives assume that markets are frictionless - bid/offer spreads arc reduced to zero, order size does not affect price or inventory slippage effects and credit risk are non-existent In reality, however, markets arc not frictionless While theoretical methods have been suggested to address this problem they still inadequately reflect real market situations This forces practitioners to use sub-optimally efficient methods c) The current methods for derivatives pricing and hedging depend on the dynamic of imdorlymgs model, thus creating a model risk that can be very costly if not accounted for m practice d) The current methods for derivatives hedging use parameters known as Greeks Greeks are obtained by differentiating price with respect to various other model parameters The implicit assumption behind using Greeks is that derivatives prices arc polynomial functions of these other model parameters This is not true and therefore the use of Greeks m hedging creates an additional source of approximation enor that can be costly m practice e) The current methods for deπvatives pricing and hedging assume that the undcrly gs move m infinitely small increments while in practice for all markets there is a minimum increment size often referred to as a tick or a pip f) When not assuming continuous time the current methods for derivatives pricing deal only with a s&glc future pciiod or single underlying scenario In reality, there are multiple periods and undcrlymgs to consider g) The existing methods that do attempt to address all these shortcomings are intractable practice and thus fail to provide the benefits they were set up to yield

A vivid example of the potential cost and risk to the financial system of the inaccuracies discussed above is the collapse of the hedge fund Long Term Capital Management (LTCM), where the Nobel Prize winning fund managers relied on

a model from which the market deviated. The real market deviation from the model led to an exposure of about one trillion dollars, prompting the federal reserve to engineer a bailout to avert a failure that would have otherwise disrupted the whole U.S. financial system and could have easily have extended to all international markets (Sec for example "When Genius Failed: The Rise and Fall of Long-Term Capital Management" by Roger Lowenstcin ISBN 0-375-75825-9 [46])

There is a substantial body of academic and published patents addressing derivatives trading issues. The relevant patents and patent applications found can be classified into five categories, as described below.

1. Patents that provide methods and systems to price specific types of derivatives. In this category, we can note U.S. 4,642,768, U.S. 5,799,287, JP 2001067409

2. Patents that provide methods and systems to automate the derivatives pricing process. In this category, we can note U.S. 6,173,276, U.S. 5.692,233, and patent applications US20020010667 and US20020103738

3. Patents that provide methods and systems to speed up the derivatives pricing process. In this category, wo can note U.S. 5,940,810 and U.S. 6,058,377.

4. Patents that provide methods and systems to better hedge derivatives or manage the risk of derivatives books. In this category, we can note, U.S. 5,819.237, US6,122,623 and patent applications US20020065755 and WO0133486

5. Patents that provide methods and systems to more efficiently trade specific types of derivative contracts. In this category, we can note U.S. 4,903,201, U.S. 5,970,479 , U.S. 6,421,653, U.S. 6,317,727 and U.S. 6,347,307

All those patents while presenting benefits over their prior art face limitations addressed in this invention.

In a recent article in the Journal of Finance on patenting in the field of finance methods and formulas, the author1 found problematic the failure to cite academic research in prior art reviews of patent applications or granted patent. Our detailed description thus start by reviewing reviewing the academic literature.

1 Josh Lerner " Where does State Street Lead? A First Look at Finance Patents, 1971-2000" THE JOURNAL OF FINANCE VOL LVH, NO 2 APRIL 2002 [45]

BRIEF SUMMARY OF THE INVENTION

This invention relates to methods, systems and computer programs to facilitate the formation trading and risk management of derivatives contracts on one or more underlying.

It provides a new framework and significant improvements in the following areas:

1. The decomposition of any derivatives contract into fundamental building block structures called basis instruments that arc financial contracts in a multi-period, multi-securities market.

2. The incorporation of supply and demand price sensitivities in the pricing of derivatives contracts.

3. The incorporation of credit risk in the pricing of derivatives contracts.

4. The development of methods, systems or computer program products for the accounting of derivatives contracts in compliance with FAS 133 or IAS 39. '

5. The development of methods, systems or computer program products for the pricing of derivatives contracts.

6. The development of methods, systems or computer program products for the risk management of derivatives contracts.

7. The development of methods, systems or computer program products for the trading of derivatives contracts whether in organized exchanges or in over-the-counter (OTC) markets.

BRIEF DESCRIPTION OF THE SEVERAL VIEWS OF THE DRAWINGS

Fig 1 gives an overview of the prefened embodiments of the invention

Fig 2 describes the sequence of contractual agreements and cash flows m a BIC

Fig 3 describes the format description of derivatives contract in the DCWBSOF format and how it is compressed m the DCWOF format

Fig 4 describes the steps of the iterative decomposition process, how derivatives contracts and BICs arc itcratively combined to yield the price of the derivative contract

Fig 5 describes an embodiment of the present invention in a pricing system

Fig 6 shows a screenshot of an embodiment of the present invention implemented m an online pricing system wherein any user specify and name their derivatives contract payout payment function (paoff fimction) m a functional format as well as their BICs m a functional format and system parameters such as time and space increments

Fig 7 shows how BICs functional format is input m an HTML page

Fig 8 shows how the derivatives contract m DCWBSOF or DCWOF is input m an HTML page

Fig 9, 10,11,12 & 13 show an embodiment of the present invention m an exchange system

The exchange trading system of Fig 9 comprises throe types of playois

• The price takers operating 1

• The market makers operating 3 and 4

• The exchange system management operating 2 and responsible for control and compliance operations clearing and settlement verifications and more globally exchange system risk management

1 contains an input interface 11 through which the price taker may describe a product of interest for pricing information 15 or put an order 16 on an identified product That input interface 11 may be a keyboard a mouse, a pad, a microphone or any sensor capable of understanding messages transmitted by human senses, 1 also contains an output interface 12 that may be a screen, a speaker a printer, or any device transmitting signals decipherable by human senses and understandable by the human bra 1 also contains an authentication process 13 that uses various authentication algorithms to confirm the identity of the price taker prior to authorizing any operation with the exchange system The pricing information 15 as well as the order confirmation 17 or the trade confirmation 18 arc channeled through that output interface 12 to the price taker senses Through the input interface 11 the price taker sends information relating to the product of interest as m 19 of Fig 1 As further specified in Fig 2, the product of interest is specified the form of a fimction f as / (5f S"', 5 S"L) The function / may be described a computing language that could be easily understood by price takers and translated by the server of the exchange system m 28 to be ready for decomposition in basis instruments

2 contains compliance and control systems 27 that check and authorize operations performed by the price takers or the market makers. As further described in Fig 3., 28 performs, if necessary, the transformation of relation (26) described in our detailed description that takes as input a fimction of unspecified parameters βt and ΩΛ as well as the Si 's and returns as output to 21, a function of solely thcSf 's. 21 further taking as input the most competitive basis instruments prices with the references of the market makers quoting them as provided by 22, uses the iterative decomposition algorithm of relations (20) to compute the price of the desired product which is then returned to 15. The basis instruments prices in 22 arc taken from individual market makers quoted basis instruments prices in 25 and 26 for example and by selecting the most competitive of each of the basis instruments with the references of the quoting market maker. If the price taker now decides to put an order on the product, this indication is channeled through 16 to 21 which then sends the order confirmation through 17 to the price taker, and the references of the price taker as well as the market makers arc sent to 24 for clearing and settlement. Trade Confirmations arc then sent through 18 to the price taker and through 32 to each relevant market maker with information on the nature of the basis instrument contracted.

The exchange system may operate as the counterparty in each transaction cither with the market makers or the price takers. In this instance, the exchange system would act as the guarantor of each obligation cither to the market makers or the price takers. It would then put in place a credit management fimction to hedge against the risk of default of any counterparty. This could be done through traditional means such as margin requirements or through credit derivatives by allowing basis instruments based on undcrlyings described in our detailed description to trade and by entering into contracts in which the credit risk is shifted to the most credit worthy players. The exchange system may also decide to let each party bear the credit risk of his or her counterparty and act solely as means of exchange, but then credit exposure management would be a very complex task for each and every counterparty to handle. If an exchange system is setup to be the counterparty in each transaction and if the credit risk function is managed properly, with the exchange sot to have the highest credit rating possible so as to be considered the risk-free counterparty of reference, this would give such an organized exchange a competitive advantage over OTC derivatives markets. If furthermore it decides to hedge its exposure by entering into credit derivatives contracts, this would create new markets for credit derivatives.

Another critical feature of the exchange system for computational purposes is that when the number of possible states of the selected random variables grows large and the number future periods grows as well, the computational cost to price a derivatives contract becomes at least of the order of 0(s'""n). So an actual system would include sonic dimension reduction variables transformations to reduce the number of variables on which the various derivatives contracts prices as well as the various basis instruments price depend. Also, in order to reduce the number of states, some actual algorithms would sample only some limited number of states to infer the price of larger combinations of basis instruments prices.

3 and 4, which are just 2 examples of systems operated by a potentially larger number of market makers, contain an input interface 35 as in 11 and an output interface 36 as in 12. It also contains an authentication process 37 for market makers as in 13 for price takers. Each market maker selects a model and model parameters 34 that can be processed in 31 to yield the market maker's quoted basis instrument prices that arc subsequently sent to 25. 34 is further detailed in Fig. 3 and shows that the model and model parameters description function is divided into a counterparty credit risk model 341, models of the stochastic process followed by the undcrlyings 342, models of the scaling density fimctions 343, and models for delimiting the range of basis instruments quoted 344 , all this combined as further defined in our detailed description to yield in 31 the quoted basis instruments prices. 3 and 4 also contain in their Assets and Trading Information Database 33, an inventory of the market maker's position in all basis instruments held. Trades Confirmation and settlement information from 24 are sent to the market makers through 32 where the information formatted for the

output interface. All relevant information storing is done in 33.

While the drawings of figure 9 only involve a single price taker, only two market makers and only a single Exchange System Management administrator, it is fairly obvious this is to case presentation and that an actual such system may involve a larger number of price takers, market makers and exchange system management personnel.

Fig 14. describes an embodiment of the present invention in a risk management system.

The description of the risk management system is based on our decomposition of any derivative in basis instruments and our method for obtaining the implied conditional probability density functions from market basis instruments prices. The Risk Manager communicates with the Risk Management or Decision System 6 via an input interface 68 as 51in 5, 11 in 1 or 35 in 3 or 4, and an output system 67 as 52 in 5, 12 in 1 or 36 in 3 or 4. The Authentication Process in 65 is as 53 in 5, 13 in 1 or 37 in 3 or 4. The Risk Manager sends portfolio position requests to 66 which process them in 64, which then send a request to 63 to check the inventory of basis instruments positions held, another request may also be sent to 61 to obtain the market basis instruments prices. Using our formula [16] obtained in our detailed description to extend the Brccdcn Litzcnbcrgcr formula, we obtain the conditional probability density function in 62, which together with the basis instruments help obtain the value of the portfolio held, compute various pro-forma or non pro-forma reports which help better apprehend the risk and opportunities of the position held. For example, value at risk scenarios can be generated with exactly market-accurate probability of occurrences directly linked to the actual costs of available hedges.

Fig 15 & Fig 16 show how an embodiment of the present invention enables Value At Risk (VAR) risk management.

Fig 17 shows how a portfolio managed in a VAR framework potentially exposes to potentially unbounded losses(yl) in likely scenarios ( state between xll and xl2) that may fall out of the confidence interval. On the contrary, an embodiment of our invention enables risk management in which a maximum worst case scenario loss can be ascertained with certainty by enabling precisely designed contracts to achieve that goal.

Fig 18 shows how computer implemented methods may be used to reduce computational time in the specification of BICs and the resulting derivatives price computation.

Fig 19 shows how computer implemented methods may be used to reduce computational time in the specification of derivative contracts and the resulting derivatives price computation.

DETAILED DESCRIPTION OF THE INVENTION

1 Introduction

The present invention introduces the notion of basis instruments as the building blocs for pricing or hedging any derivative security defined in the most general sense. It describes a decomposition formula that precisely shows how any derivative security is decomposed in these basis instruments. The importance of these basis instruments tools cannot be overemphasized. A top-level understanding of their relevance may start by asking the two following questions with no apparent bearing on the issue at hand:

1. Why mapping the human genome in 2000 was hailed by the medical research comm mity as one of the major scientific achievements of the century in the field?

2. Why was Mcndclcicv's (1869) description of the periodic table of elements such a foundational achievement in chemistry and physics?

In answer to the first question, we have been explained that identification of the role of each gene in our DNA will help understand the causes of most genetic diseases, facilitating tailor made cures. Although in most cases, these benefits are yet to be seen, governments and private sector have and continue to invest massively in this endeavor.

In the second case wc now know for sure that because Mcndclcicv's table helped scientists understand that all physical matter were just combinations of his basic elements, it became clear that all desired materials could be built by doing just such combinations. The issue shifted to economics: how to make such combinations most cost effectively? In cases where cost effective processes have been found, this has led to the development of chemical industries who have taken advantage of the opportunity and helped build the wealth of nations by satisfying our needs for all kinds of materials. Research still continues to expand to find more cost effective processes to manufacture needed end products.

In financial derivatives risk management, our identification of the basis instruments and the characteristics of each one of them can be likened to the identification of the gene as the unit clement in the expression of each living being descriptive feature as well as the inventory of all possible genes. In chemistry or physics, the analogy is the atom and the inventory of all atoms given by the Mendclcicv table. Our decomposition formula is analogous to describing the genetic composition of each possible living being, once identified; in physics or chemistry, our decomposition formula could be equivalent to providing the atomic composition of each described material, whether solid, liquid or gas.

These analogies are intended to relate to the importance of the proposed innovation. A survey of published literature will help put this innovation in the proper context.

Published literature directly relevant to Definition 1 and Theorem 1 discussed later, arc the contributions of Kenneth Arrow (1953, Nobel Prize 1972) and Gerard Dcbrcu (1959, Nobel Prize 1983). Arrow and Dcbrcu defined what arc now called Arrow-Dobrcu primitive securities (and Arrow-Dcbrcu state prices) as the basis elements in which all other contingent claims could be decomposed into in a single security, single future period market (but with multiple possible states). Arrow Dcbrcu securities arc simply securities that pay $1 at the end of the period if a given state occurs and nothing if any other state occurs. If there is one Arrow-Dcbrcu security for all possible future states, then a claim

contingent on future states can be decomposed into such securities. To sec how this happens, one can observe that if f is a function defined on Σ, set of all possible states the variables S can take, wc have the trivial identity:

/(S) = ∑ /(*) x l{s=.> (1) where 1-js-,} represents the function taking the value 1 if S is equal to s and the value 0 if S is equal to any other value.

The application, which to each payoff at a future time T that is a function / of S stochastic variable known only at T, associates the current value of the contract is an homomorphism of group if state prices arc taken as fixed. In the traditional risk neutral pricing framework, this can be seen in the pricing by taking expectations and the discount factor J5(*θι *o) which represents the value at t0 of the security paying 1 with certainty at time to- Wc have:

-E(/(-S.. )-9 (-o. tι)) = E £(/(•■>') l<s-1--_}£ (i0, -ι)) = ∑ /(«) x Pr o -S-.. = β)-9 (-o, -ι) (2)

..e∑ «6∑

In a single period market, since every contingent claim on the value Stt of the underlying S at time t0 will have a payoff that can bo mathematically written at time to as a fimction of Stl t i.e /(-St. ), identity (1) demonstrates the Arrow-Dcbrcu result that any contingent claim, which can always be described by a function /, can be obtained as a sum of f(s) securities paying 1 at time to if _->{. is equal to a particular value s and zero if any other value is taken, with s spanning the whole range of value S may possibly take at time t0. Let's further detail this concept in a simple example.

Let's suppose wc arc on Oct 27,2001. We consider the simplest case of a ticket purchased at 10AM EST(Eastern Standard Time), October 27,

representing a bet that the New York Yankees (AL) will have won the 97th Baseball Wforld Scries against the Arizona Diamondbacks (NL) at the end of the day on November 4th, 2001. If this event occurs the ticket holder will receive $1.00 at 10AM EST on Monday Nov 5, 2001=*

7, otherwise he will receive nothing. There arc only two possible outcomes/states; with probability πr^i state 1 of nature, that is AL winning will be realized and with probability ττo,

2 state 2 of nature, NL winning will be realized. We also assume fractional dollar bets can be purchased. Using daily fed funds rates reported by the federal reserve, wc obtain B(t

0, tγ) = 0.9994.

So, the NY Yankee victory bet is an Arrow-Dcbrcu security in this state space and we denote it . Let's suppose there is market consensus on 10/27/2001 that there is a 40% (= πrj.i) chance that the NY Yankee will win and a 60% chance that the Arizona Diamondbacks will win (= TTQ^ -

Since there arc only two possible states for the lottery ticket at time -7, there remains only one Arrow-Dcbrcu security to be described to have what is called a complete market, i.e. one in which all other contingent claims arc mere linear combinations of elements of the set of primitive securities. This remaining security is listate 2}-

Since B(to, tf) is traded in the market, i.e. deposit accounts paying the fed funds rate exist, Instate 2} is redundant since: l-fst-tie 2} = 1 — I-;-?*-.*-- 1} (3)

Since $1 can be safely replicated on 11/05/01 with $ 0.9994 on 10/27/01, this allows a static replication of on 11/05/01 by selling on 10/27/01 a bet ticket for $ 0.4 0.9994=$0.39976 adding $0.59964 to it and depositing the sum equal to $0.9994 in a safe account paying the fed funds rate. Indeed if the Diamondbacks win, the bet ticket will expire worthless on 11/05/01 so that one would receive $ 1 from the deposit paying the fed funds rate; if however, the Yankees win, the $1 taken from the deposit account will be used to pay the holder of the bet ticket sold on 10/27/01. As such the

position built is exactly equivalent to buying a ticket paying $1 on 11/05/01 if the Diamondbacks win and zero otherwise.

Let's suppose now that wc have a derivative security paying f(Str) at time t . Since there arc only two possible states, / is a binary (Boolean) unction and wc note j = f(Stateϊ), f2 = f(State2). Using the Arrow decomposition, wc postulate that holding the derivative security paying /(-->_-) at time -i is equivalent to buying ( i — /2) identical lottery tickets paying 1 if AL wins and putting $ 0.9994 2 in a secure deposit accoimt paying the overnight fed fund rate of interest. Indeed, it is easy to see that if state 1 occurs at tι, one receives $ ( i — jfø) for having the winning tickets and adding to that the $ f withdrawn from the secure deposit accoimt, one ends up with $ /j . If however State 2 occurs, one receives nothing for the lottery ticket and ends up only with f^ withdrawn from the secure deposit account. Thus the equivalence with the derivatives security paying f(Sfr) at time -7 is evidenced.

The problem wc faced to begin with was that, since the end of the fifties and beginning of the sixties when those early works were being pioneered, little has been done to extend these Arrow-Dcbrcu securities as primitive securities in a multi-period market where there may be many securities without making questionable assumption-.:

In the early 1970's, Black, Scholcs (Nobel prize 1997) and Morton (Nobel prize 1997) made the assumption that the dynamic of securities followed a pattern similar to that of a stochastic process called a geometric Brownian motion with a constant parameter called the volatility. They thus derived what is nowadays known as the Black-Scholcs-Mcrton formula. What made this model appealing was that if its assumption held, the basis instrument from which to replicate any contingent claim on an underlying would be the underlying itself. Black. Scholcs and Merton showed that a dynamic hedging strategy would be instantaneously risk free if it consisted of selling an option (or any other contingent claim) and buying the underlying in quantities equal to the derivative of the price of the option with respect to the underlying (also called delta) according to the formula they calculated. Under a most general extension of their work, the argument goes as follows:

Let's suppose the underlying follows a diffusion process, i.e. dSt = μ (S f) dt + σ (St, t) dWt (4)

Then if one considers a contingent claim on the security S whose price at any time t can be obtained as a fimction of the value of the underlying S at time t and t. itself, i.e. f(St, t), then, if also assume / is twice diffcrentiable as a fimction of St and diffcrentiable as a function of t, then one can apply the well known It lemma which gives: df = { + μ {S t} + 2 {St ' *} f)dt+σ {St> t (5) can be rewritten, using (4) as:

/(-7-+Δ- = 5, * + Δi) = f(St = F) + ?L(St = F)(S - F) + (?l + lχ {St,t) g) At + θ(At) (7) or

f(S

t+Δt = S, t + At) - f(S

t (F, t) ) At + θ(At) (8)

that is

E (/(- = St + At) - f(St = F,t) - §£(St = F)(S - _*) - (% + σ2 (F t) f^) At

= 0

Δ. →O Δ.

Formula (6) shows that a portfolio consisting of a long position m the derivative contract whose value is equal to f(St) at any time t coupled with a short position in § units of the imderlymg is solely a fimction of time, thus risk-free Thus it should earn the risk- free rate of return rj,(t) So if one writes

π-(St) = /(■ St) - S then -OI, (Si) = Ut(St)rd(t)dt (9)

Since St pays a dividend at a rate named rf(t) assumed to be constant between t and t+dt rf (t)-^dt should be subtracted from the variation of ILf (St) coming from (6) Thus,

In the case of a Call Option struck at K and maturing at T, it is known that

f(ST, T) = Call(ST K T T) = (Sτ - K)+ (11)

If it were assumed that the imderlymg followed a geometric Browman motion with constant πsk-frcc rate r and volatility and no drift one would have

(12) and (10) wore obtained by Black, Scholcs & Morton Recognizing m (12) an equation reducible to the heat equation well known Physics they were able to derive the celebrated closed form formula carrying their name

Call(S0, K, 0, T) = S0N(d0 + σV ) - Ke"TN(d0) mfh ^= w-./w-^ (13)

In obtaining this result, the following assumptions were made (i) It was possible to trade m continuous time

(n) Market on the underlying was perfectly frictionless, by frictionless wc mean no transaction costs, no bid/ask spreads no restrictions on trade (legal or otherwise) such as margin requirements or short sale restrictions, and no taxes There is infinite liquidity

(in) The dynamic of the underlying follows a geometric Brownian motion with constant risk-free rate of return and constant volatility

Assumption (?) has proven impossible to realize m practice because of physical limitations and the importance of transaction costs, derivatives portfolio managers tend to rebalance their portfolio to adjust the sensitivity of their portfolio to spot changes once or twice a day

Assumption (ii) is just not true m practice and virtually all data scries for undcrlymgs traded in open markets display skew and excess kurtosis incompatible with the geometric Brownian motion assumption of (nt) The failure of portfolio insurance m the 1987 stock market plunge and to some extent the "noimal" assumptions behind the failure of LTCM

in 1998 ([46]) reveal that adhering to such assimiptions can have a potentially devastating effect on the stability of the U.S. financial system. The resulting appearance in 1987 of smile and term structure of implied volatility quotes in vanilla options markets and the increased liquidity of vanilla options led to the development of a model by Dupire, Dcrman & Kani, Rubinstein ([25] [53]). This model is based on the assumption that vanilla options (Call/Puts) for all maturities and strikes arc the basis securities from which the price of all subsequent derivatives instruments, path dependent or not, might be inferred. This model, while having theoretical appeal, has not been validated by empirical tests ([24]). In fact, practitioners price path dependent options with concerns for the Vega-convexity due to the stochas- ticity /uncertainty of volatility in a manner that cannot be reflected in Dupire & al, ([25])). A close analysis of the Dupirc-Derman-Kani-Rubinstcin model, if wc position the problem in finite future states that correspond to the reality, shows that accepting their model would be equivalent to stating that a system of sn unknown would be determined by ns equations without any empirical or economic justification on the rule used to determine the remaining sn-ns equations. The most advanced models used in practice arc now going back to and extending models with Poissonian jumps or stochastic volatility earlier pioneered by Morton [50] and Hull and White [40]. However, Das and Sundaram [19] have shown that the term structure patterns of these models are fundamentally inconsistent with those observed in the data. Stochastic volatility models, which fare better than jump models in data description according to Das & Sundaram, arc foimd to lead to greater incompleteness as quantified by Bertsimas, Kogan & Lo [6]. It now appears there arc a wide range of new models of markets dynamics to replace Black-Scholes, all without clear undisputed winner for all circumstances. The proliferation of these models has created additional difficulties to mark non-standard derivatives to market, making it difficult to strictly abide by FAS 133 & 138 ([28], [30]) for accounting for derivatives positions in financial statements; the Financial Accounting Standards Board (FASB) introduced on June 15, 2000 [30] mandatory compliance with FAS 133, the latest accoimting rules for derivatives to emerge since 1984. Reporting non-standard derivatives in balance sheets and derivatives P&L on income statements at fair market value, as is requested in FAS 133, can be a daunting challenge due to lack of liquidity on these products and the lack of standardization of mark-to-markct methods. In the derivatives market the recent loss by Allfirst of $691 million in foreign-exchange losses went unnoticed over a couple of years due to inappropriate mark-to-markct of its derivatives positions. The existence of decomposition in basis installments and the existence of a market for these basis instruments, as made possible by the present invention, solve the problem in a definitive way. Furthermore, FAS 133 requires that derivatives be accoimtcd as hedges and their profit and loss (P&L) reported in the Other Comprehensive Income (OCI) section of financial statements only when it can be shown that this P&L offsets that of an existing underlying in at least 80% of the risk of fluctuations in the value of this underlying. This creates potential confusion as to how to estimate this 80% value among the wide choice of possible models. Patents applications WO 02/44847 A2 or US 2002/0107774 Al are one of the many model dependent approaches to address the issue. The existence of a market for basis instruments would conclusively address this issue. Finally, all those models, by assuming continuous-time processes arc only approximations to physically realizable phenomena, due to the existence of transaction costs. In fact, Bertsimas, Kogan & Lo's [6] quantification of this approximation show that even if lognormal assumptions were true, the approximation error may be of significant magnitude for some payoff types, further reducing the effectiveness of all the models surveyed for hedging purposes.

Moreover, in obtaining the PDE (12) or (10), two important assumptions were made which arc not always true in practice:

• It was assumed that the derivatives contract could be put in the form f(St, t)

• It was assumed that the asset followed a diffusion process, thus we could apply It's lemma.

In practice, for many important cases the derivatives contract s price cannot be obtained as f(St, t) for all times t Additionally, extensive mathematical finesse is rcqmrcd to derive an applicable PDE for each new derivatives contract under the diffusion process assumption Such extensive mathematical methods can not be not readily automated The approach to obtain the PDE for the Average rate or the Lookback option may exemplify this difficulty Sec for example the PDEs compiled Rogers & Talay [52] When no diffusion process assumption is made it is substantially more difficult to obtain a tractable PDE One must then resort to trees or Monte-Carlo computations for pricing purposes More significantly, it is difficult usmg these methods to understand how to incorporate micro structural issues m the pricing of derivative contracts Our invention does enable easy incorporation of micro-structural issues when pricing derivatives

The current approach for managing the risk of a portfolio of derivatives is by hedging the Greeks of the portfolio The Greeks arc the sensitivities of the portfolio to different market variables Delta is the sensitivity with respect to variations in the asset price Gamma is the sensitivity of the Delta to variations in the asset price Vega is the sensitivity of the portfolio to variations m its Black Scholcs-Mcrton implied volatility Theta is the sensitivity to time Higher order sensitivity parameters also exist, with non-standard names In general, hedging strategies arc aimed at matching first and second order derivatives of portfolios to the various parameters In doing so, what is implicitly assumed is that the sensitivity of portfolios of derivatives to their parameteis is polynomial and of degree 2 or 3 or 4 for the most accurate hedges

For example, one would take a portfolio π(-Sf s) and write U(S, t, σ r) m U(S0, t0, σ0, ra)+

-, ( cM(Sa,to,σa , p) f)π(So to σg ; o) dn(-?o , o σg va ) r.π(St> to σg,ι g) g c + * , ^ „ „, \ ---

< ^ as > Wt > άi > a. J > (t> - bo, t - to, σ - σ0, r - ro) >

XiS - So t - to, σ ~ σ0, r - r0)H (So, to σo, ro) (3 - S0, t - t0, σ - σ0 r - r0) + whore H is the Hessian of π with respect to the variables Sf , r, r and then one would consider that a perfect hedge for π(S', t , •>) would be a portfolio matching the value at the initial point as well as the first and second order sensitivities In reality however, the hedge is dependent on the model used to infer the dependence on the specified parameters Additionally, the polynomial approximation derived from the Taylor expansion is of uncertain accuracy and can lead to serious problems, especially for highly non-hncar pay-off options such as barrier options Preferred embodiments of our innovation address this problem as well

The idea of using basis elements or spanning for the pricing of derivatives continues to this date to bo an active field of research m Financial Economics For examples of recently published approaches sec Madan, Carr, Gcman Yor, Bakshi [48], [13] However, by making assumptions of continuous time hedging, brownian nitrations or scmi-martmgalc properties of the underlying and absence of micro structural effects, these approaches not only limit the possible accuracy obtained for pricing purposes but they create a model risk when one would attempt to use those results for hedging purposes using the selected basis (Characteristic function or Hermitc polynomials as m [47] [48] for instance)

Our invention differs substantially from the approaches mentioned m the prior art papers by the fact that wc focus on selecting exactly replicating basis instruments that are as close as possible to what exists on the market i c spot, forwards/futures and vanilla options Additionally our implementation is designed for computational tractabihty In the prior art papers, the authors make simplifying assumptions for mathematical tractabihty that are not always economically justifiable A recurrent feature of such decomposition approaches is to seek Hilbcrtian bases and obtain pricing by taking the projection on a few elements of the basis without clear justification of the economic rationale of the approximations Furthermore those approaches, one has first to non trivially infer or imply the price of basis

instruments from traded instruments

In their simplest form m a two state two periods economy, a preferred embodiment of the basis instruments wo introduce could be cquivalcntly defined m addition to the Arrow-Dobreu primitive security as

An agreement at time to to buy at time tι lottery ticket at the price $10, 000 π i 1 if state 1 occurs and $10, 000 τrι 2 if •state 2 occur 1 at time ti

When extendwg to n arbitrary period1,, a haws instr ument would be an agreement at time to to buy at time tk-i (1 < k < n) a lottery ticket at the price $10, 000τr/, — 1 A _I, where _! vt a k-1 series of 1 a d 2 indicating the tates of winning or losing lottery tick ets bought between time t and time rj _ι

How far into the history of these tickets wins or losses the seller will take into consideration will depend on Ins views of how past events affect the likelihood of future events

Our example of the 97th baseball World Series can be used to further illustrate the concept To win the World Series a team needs to wm four of possibly seven games For the 97th series, the games were scheduled as

Table 1 World Scries

Wc call Xt the stochastic process taking the value 1 the day after the end of each game won by the NY Yankees (AL) and the value 0 otherwise As such Xt is for t being a day after a game a bet that the Yankee will wm the game of the day before State 1 that AL wins the World Scries is thus such that

l-lSiαfel} — 1-{∑J=. x.3>4} = f(Xt1 , Xt2 , , Xt7) (15) which shows that the Yankee World Series victory bet is now a path dependent derivative contract on the realizations of the stochastic process Xt Let's suppose that to replicate this contract the only instruments wc have arc bets on each individual game and that those bets arc taken at time . n =Oct 27, 2001 at IOAM EST (Eastern Standard Time) but paid for one period before the game settlement date It is natural to expect that as games arc played estimates of the probabilities of victory m the subsequent games change

1.1 Notations

For ? = 0..6 we note: rct = π,|t+ι (-X*,+1 = 1|-XV, , -, Xta) so ^na^ 7r.,-+i (-X .+i l-X-, • ••■ Xto) = 7r-,t+ι = ■X'f.+i"'- + (1 - .XV,+. )(1 - π.) i-c: πI]t+ι ( iι+1) = (1 - 7-.) + (2τrt - 1) „,+1

For any derivative contract on the stochastic process Xt paying at time t,γ f(Xf1..Xtγ) . wc note π~ the price at the time t, of the contract paying tγ f (Xtl ..Xf7) at time tγ.

Wc suppose each team has a 60% vs. 40% probability of winning its first match in its home stadium and that this probability is increased by 10% after each game won if the next game is at home and it decreases by 10% after each game lost at home if the next game is also at home. Wc also assume that once a party wins 4 games, its probability of winning the remaining games if any is zero. These translate algebraically into:

.to = 0.4 π2 = 0.6

For ι — 1 and 3: τ, = (0.2 t, - 0.1) + π,_ι

For ι = 4 and 6: 7rs = ((0 2 fτ - 0.1) + π.--1) x l{l_3<∑.=ι_Yf;ι <4} + l^_3>∑;,=ι Xtj }

Now wc introduce our 2-statcs multi-periods basis instruments definition.

1.2 Definition

In a single process (Xt), two states (1 and 0). multi-periods market {to < t\ < t,h-\ < tn} with reference currency X®, so that " is equivalent to 1, a basis instiumcnt is defined as:

An Agreement between two parties, β and Ω contracted at time to and stipulating that either:

• At time i._ι, β shall pay Ω the amount N(Xtl , ...,Xt1_l) <8> πB_1 (Xil . ..., Xtι_λ) and at time -„ Ω shall pay β the quantity : N(Xtl , .... y.,_. ) x -X^

• At time i._ι, β shall pay Ω the amount N(Xt1 , ...,Xtl_l) ® Tr^ -V. , .... -Xiτ_. ) and at time -„ Ω shall pay β the quantity : N(Xil , .... X _l) X -X"°

When Ω pays β the quantity N(Xtx , ... , -Xt,_. ) , it is an extension on what is commonly know as a forward rate agreement and will be referred to here as a zoroth order basis instrument in the reference currency X° ■

When Ω pays β the quantity N(Xt1, :.,Xt,-ι), it is an extension on what is commonly know as an Arrow-Dcbrcu security and will be referred to here as a zcroth order basis instrument in the currency X} .

1.3 Proposition

In a single process (Xt), two states (1 and 0), multi-periods market {to < h < tn-ι < tn}, wc have the following relationships:

If wc apply this to our Wforld Scries example, to calculate the price at tO of an AL world scries victory bet, wc have:

f(Xtl , Xt2 , -., Xt.r) — 1i∑J=1 tj>4} and using our formula (16) with data (15) wc obtain a probability of 48.3% and therefore if there is a market where bets on the AL victory exists, a risk free arbitrage would be to buy a ticket betting an AL victory at 40% of the face value selling basis instruments replicating that victory bet at 48.3% of the face value, realizing a net profit of 8.3% of the face value.

The example above presents the concept of basis instruments and how this innovation is used for pricing and hedging any derivative security in the case of a single process, two states (1 and 0), multi-periods market in a way that is an innovation on the Arrow-Dcbrcu primitive securities. To infer conditional probabilities of possible future occurrences from basis instruments prices, our new method is to use the relationship

-κB Prob( t, = l|Xt0 , ..., tl_. ) = - ' -

^i-l

In the more general case of a multi-processes, multi-states, multi-periods market, in another embodiment of the invention, we will present below the more general innovation that applies.

While in a two state process, vanilla options and Arrow-Dcbrcu primitive securities coincide, when the number of states increases, the two types of contracts become different, yet the two. with bonds and forwards added to options, remain equivalent through a bijcctive transformation. Wc choose to present our basis instruments below as extensions on vanilla European options forwards and cash instruments instead of the academic Arrow-Dcbrcu securities as this basis, is more economically sensible and computationally allows a faster convergence to the desired payoff for most derivatives instruments using the lower order basis instruments and making the decomposition around the forward value around which probabilities of occurrences arc clustered. This is also of critical importance to relate to the shortcomings of the Black Scholcs Morton derivatives hedging approach. Formula (14) shows that at any trading time, a derivatives position would be hedged through cash and underlying or forwards in amounts equal to the sensitivity of the option to its underlying (or delta), but unlike Morton, there arc complementary terms representing a spanning of calls and

put options in proportions equal to the second derivative (or gamma) of the financial derivative with respect to the underlying. Formulas resembling (14) have boon lαiown before in a two period case, (sec for example [16], appendix), however these formulas have been presented with two important limitations solved in our derivation:

• It is assumed that the derivatives terminal payoff as a fimction of the underlying asset is twice diffcrentiable everywhere, substantially reducing the number of real life derivatives to which the formula can be applied. It is also assumed that the asset values state space is continuous.

• The formula is derived solely in a single asset, two period setting and thus merely presents variations around Arrow-Dcbrcu.

2 General notations and definitions

Wc suppose we arc in an m+l assets economy, with n+l trading periods t0 < -,_ι < tn... < tn chosen as scon appropriate. Sc taken by convention to be So is the base currency asset and thus merely represents the mit of cash in the reference currency and S1, ..., S"1 arc risky under lyings whose values in units of So vary across time; so, the default unit of any given number or quantity is o and when there is no ambiguity, So is simply one.

Eo,n represents the m+l undcrlyings economy between to and trl. e0>„ represents an exchange system of contracts whoso values is dependent on the realization of the m+l undcrlyings of economy Eo,,L between to and tn. j refers to the value of the underlying S' at time t3. S} l refers to the realized value of the underlying St. at time t3 as opposed to the abstract reference to the parameter value symbolized by Sj.

Fj is an arbitrarily chosen value of the underlying S1 at time t In general for the developments to be made hero, this value will tend to be the forward value for the maturity i, at time t,-_ι, or the value of S' j.

S ~ iS ) !<»<'" S = (^5J K <m F = (F]) -<<- Sj = (Sj) !<.<,„ Fl = (Fl) -<-<..-

X+ is the maximum of the real value X and zero, or Max(X, 0). If / is a function defined on [a, b], then the real b quantities noted as / f(x)dτ -ind _ (xt) arc subordinated to the definition of a finite set Ix — x0 = a < . ι < < xh = b a b i— 1 so that J f(x)dx is by definition equal to: ∑ f(xt) x (x,+1 — -s.) and §|(a.,) is by definition equal to f(^+l)~^(j:') ; ,. may ι=0 be equal to the infinity and will be truncated to a finite number only upon proof that the remaining terms are negligible within the approximation bounds sought. In general for the developments to be made here, Ix will tend to represent the actual range of values an underlying can take or any bijcctive transformation of this range. Since increments of an underlying value for all types of undcrlyings to be considered are discrete (that is there is a minimum increment value called the basis point), the cardinal of Jj, is always finite or denumcrablc ; h b

J f(x)dx may also be formally noted as f f(x)dx\ιJS. -^_ (x%) may also be formally noted as f (xι)lι-- F°r any x £ IΛ, a there exists a j < n

Multiple derivations or integration signs for functions of several variables simply moan that the operation is iterated on b

k b

1 the specified variable in the integration or derivation symbols. / .. / f(x

1, .., x

k)dx

1dx

k may also be formally noted as

/ J f(s

l ,A)dX dX\

l,

/ .

όJ' AX,., '

; ) may also be formally noted is

,ι

jV The indication j . 7j I on the integral may be omitted when the subordinated intervals partition is evident in the context or irrelevant If x element of Ix is equal to -r_. , then -r+ is by definition -ij+i, x++ is by dcfimtion x3+2 and J _ is by definition Cj-i lϊ j = •> J + is by definition j , j.+-|- is by definition τ3 , if j = 0 r_ is by definition x.

If p is a real, s/.gn(p) = + if p > 0, ιgrι (p) — — if p < 0, sιgrι( ι) — (mid), if p = 0 The convention τsιqn{μ) ΪS llhCfi m the result presented below -≡ between two quantities identifies an equality between the two quantities which is true by definition For any sot A included m a larger set X, for any -r 6 X , wc define the function 1_ as 1^ (-r) — 1 if -r e A , 1.4 (»") = 0 if not If A is defined by a Boolean condition, A m 1_ may bo replaced by that condition

The key to the solutions described m the present invention as will be further detailed below is the introduction of functions of real numbers rather than just real numbers in expressing payment terms m premiums of contracts a way that has practical meaning

3 Basis Securities definition and notations

In order to make the definition more accessible wc stress characteristic features of the Basis instruments as used in a preferred embodiment of the present invention and the rationale for those features,

(1) A Basis instrument Contract (BIC) is a contract and involves and identifies two parties named buyer β and seller Ω

(2) The dcfimtion of each contract comprises three dates

• The contract agreement date t which is the date at which the binding rights and obligations on both sides of the contract arc agreed upon

• The premium payπient date tτ , with t, > to which is the date at which the party identified m the contract as the buyer β complies with its part of the agreement by paying the seller Ω an amount in units of basis currency known as the premium of the contract

• The contract expiry date also known as maturity t3 with tj > tτ , which is the date at which the party identified in the contract as the seller Ω complies with its part of the agreement by paying the buyer β an amount m units of basis currency defined as one of the generic form further detailed below

This facilitates the formation of BICs between trading parties and can be implemented m a system or computer program product

Definition 1

A basis instrument B

taιtτtt (β Ω, N (»ι, tk) Si

(-.1

. , j

p)) is a security contract entered into at time t

0 between a buyer β and a seller Ω stipulating that

• At time t, β shall pay Ω a premium payment amount such as

-9feΛιtj G9, Ω N, (t1 ιk) (δ1 δk), (Kt, Rf ) i, 3p)) (Sι, Xt

≡ N (Sι, St,) & -B$,AA ((tl , tt) (<-ι, A), (-ffι , -K-fc), ι, ,3p)) (Sι , , St,)St units of underlying currency S'

• At time t, , Ω shall pay β a payout payment amount such as.

N (S£ , • • • , S%, ■ ■ • , S , • ■ • , S£) (δi (S% - KX) ) + • • • (δh (S% -Kk))+S{}... S?;Sg units of underlying currency S'- And where φ , called the scaling density function is an application such that: Bt0)ftttι(β j1.---,jp))(Sl-,---,St,)≡ N (&.; ■■•

B-'„

χs-i,-.,-, ((<ι.

• • • » H). (

5ι>

• • • , ), (#_,

•••, -sTk), (ji,

• • • , h)) (Si;---, S

t.)SP

Whore No 1S ^nc inventory of the of the counterparty selling

^*o,..... O9' Ω> N> (*!'•••• ?'fe)' (5ι. ■ • • . <*.). (-^l. ' ' • . κk)> (h, ■ ■ -, >)) Prior to thc Haid transaction.

5*-.w- ((*!«• • •»»'*)• tø» ■ ■ • > **)» ^ ■ • • ' *)» (Λ« • • • » Jp)) ( : •■•'*.)

-= 1 > -B^oΛιtj ((»!, • • • , ik), (<.!,•••, <.*.), (ϋfi, • • • , Kk), &.•••, ->)) (Si;---, St.) The sot of Basis Instrument Contracts is called a BIC -Basis.

When the payout payment amount is in the format

N (SΪJ, . • ■ , _S£, -,S£.-~, S£) ( (sj; - iT1))+ • • ■ (δk (s% - -fffc))+ s?/ ... s «

, then wc term it an Extended Option Format Basis Instrument Contract Payout or EOFBICP. It naturally imply the premium payout format -1^,fl,w.(^l (^■•■'14).(Jflι■ ^)■ϋl,■• ,))(Sl;••^)^

= N (Si; •••, S ® S ,*. ((*!>• - ^,^ The EOPBICP is used here to facilitate teaching of the present invention. Other payout formats can be used to create a BIC-Basis. Such format may include Extended Arrow-Dcbrcu Format Basis Instrument Contract Payout or EADF- BICP, the Extended Fourier Transform Format Basis Instrument Contract Payout or EFTFBICP, the Extended Hcrmitc Polynomial Format Basis Instrument Contract Payout or EHPPBICP. All those format arc equivalent and from a complete set of one kind, a complete sot of the other kind can be obtained through a linear transformation. In a preferred embodiment of the present invention a few examples of the linear transformation are disclosed in a matricidal form.

The scaling density function translates how the offer and demand for each basis instnmient in turn affects the level of prices. This phenomenon is also known in securities markets as slippage. For 0 < p < k+ 1, Kp is a priori a function of

(ft-;-Λ).

N (5*. ; ■ ■■ ,Stz) is called the notional of the contract.

N (Stl; ••-,&,) ® Bξ0jtt>tj (( , ■ ■ -,ik), ((.!, • • • , δk), (Ki,-- ■ ,Kk), (ji, ■ ■ -,jp)) (Si; • ■ • , S )S^ is the premium or price of the contract. k is the order of the basis instrument. When k = 0, the basis instrument is simply noted as n t t (N) and when in addition, v( , ((*!.' ■■Λ)ΛSι,---Xk),(Kι,----Kk),(jι,---,jP)))(N (sι;...,s ) = N (Si; ••• ,Stt) BiaMj (( ,.. -,ik),(δι,---,δk),(Kli...,Kk),(j1>---,jp))(Sι;---,St,)

, the basis instrument is simply noted as -B . 1. 1,..

When the basis instrument price at docs not depend on (Si; ■ ■ ■ , -St€) as is the case for zcroth order basis instruments, the notation of the price is the same as that of the basis instnmient contract.

In current markets, for most market makers, φ is a stcpwise increasing fimction, —φ(—N) — ψ(N) > 0 and is called the bid/offer spread. For practical implementation purposes, in a preferred embodiment of the present invention, may be defined and input in an implicit or explicit manner. Examples of an implied input or definition are provided further below.

Recent patents have addressed the problem of financial market liquidity in the context of an electronic order-matching systems . Patents relating to derivatives, such as U.S. Pat. No. 4,903,201, disclose an electronic adaptation of current open-outcry or order matching exchanges for the trading of futures is disclosed. Another patent, U.S. Pat. No. 5,806,048, relates to the creation of open-end mutual fund derivative securities to provide enhanced liquidity and improved availability of information affecting pricing. This patent, however, docs not contemplate an electronic derivatives exchange which requires the traditional hedging or replicating portfolio approach to synthesizing the financial derivatives. Similarly, U.S. Pat. No. 5,794,207 proposes an electronic means of matching buyers' bids and sellers' offers, but outside the scope of an electronic derivatives exchange which requires the traditional hedging or replicating portfolio approach and without explaining the nature of the economic price equilibria achieved through such a market process.

U.S. Pat. No. 5,845,266 and U.S. Pat. No. 6,098,051 implement order-matching and limit order book algorithms, which can be and are effectively employed in traditional "brick and mortar" exchanges. Their electronic implementation, however, primarily serves to save on transportation and telecommunication charges. No fundamental change is contemplated to market structure for which an electronic network may be essential. Second, the disclosed techniques appear to enhance liquidity at the expense of placing large informational burdens on the traders (by soliciting preferences, for example, over an entire price-quantity demand curve) and by introducing uncertainty as to the exact price at which a trade has been transacted or is "filled." On the contrary, a preferred embodiment of the present invention is to provide through the scaling density functions a functional format that reduces the size of the data to be supplied to the system and in effect eliminates the need for a trader to continually update their bids and/or offer responsive to demand. In fact, once the scaling density function has been provided for all basis instruments contracts, there is no need for further trader intervention and the trader or market maker knows very precisely for each quantity transacted at which price the transaction concluded.

What is different between this type of contract and other types of derivatives contracts is the functional nature of the premium as expressed in the definition of the contract and the introduction of the date tj as separate and posterior to to- While it is true that in most OTC contracts there is a contract date and a settlement date different from the contract date, the difference - with assuming as is done for modeling purposes that the contract date and the premium payment date arc the same, is minimal and it is straightforward to make the adjustment. So, each of the dates tL- and tj may actually be coupled settlement dates a few days later.

The premium is expressed as a fimction of the values of the fluctuating variables between time to and time . Enabling this extension is what makes possible the most critical sections of this invention. Moreover, the payment at time tj is expressed as units of a specific basis set of fimctions of the fluctuating variables at time tj with scaling units being- functions of the fluctuating variables between time to and time . The choice of the specific fimctions is made so that the selected basis set is a mathematical basis of the vcctorial space of functions of the fluctuating variables at time t

with the scalar units belonging to the set of values (i.e. ) taken by functions of the fluctuating variables between time to and time tj. Since in a vcctorial space all bases arc equivalent, once one has been selected, any other basis would be equivalent to that one. As a result the claimed scope of the invention is not intended to be limited to the specific choice made herein for illustrative purposes, but rather to encompass its possible equivalent. In the specific case of the illustrative definition above, the basis is selected to be as "close" as possible to known instruments actually traded in the markets, that is bonds, forwards/futures and European vanilla calls or puts. The notion of "close" is meant in particular in the sense that if the scalar set becomes the field of real numbers, as happens at tj , then wc would recover classical bonds, forwards/futures and European vanilla calls or puts. When tj — = 1 day, wc would have the known overnight options, and overnight repos commonly traded in OTC markets. In doing this, wc express preference for hedging purposes, over alternative existing approaches where the basis is selected to be hilbcrtian with respect to a defined scalar product, and merely has computational appeal for pricing purposes.

The fimctional nature of the premium and the scaling units is essential for the derivation of the decomposition formula from which the basis instruments derive their usefulness as hedging instruments.

3.1 Methods of supplying BICs

As seen above there are various ways of supplying BICs depending on the structure of data available or computational consideration made, one might prefer one over the other. Wc show here an example of how to move between EOFBICP format, EADBICP format or EFTFBICP format.

3.1.1 Correspondence between EOFBICP format and EADBICP format

We have the following result, establishing the correspondence between basis instruments prices and unit underlying- conditional probabilities that extend and generalize the Brcedcn-Litzcnbcrger formula ([10])in a multi-periods, multi- imdcrlyings setting:

This formula shows that with the price of basis instruments non-neccssarily linearly dependent on the notional, the conditional probabilities arc also dependent on the on the notional amount.

In a discrete environment we further obtain matricial relationships. We show here how to transform conditional Arrow- Dcbrcu state-prices into Basis instruments prices & recovering Arrow-Dcbrcu statc-priecs from Basis instruments prices.

Wc define the conditionnal basis instruments prices veetore as Btτ_1 ft and the conditionnal state-price vector as Patt_lit

For fc > /ι, -3?,_.,tl(l, fc) = 0 and for k > h. Paa_ (1, fc) = 0; For fc < -, Bl_ i (1, fc) = 0 and for fc < h, Paξt_1)tτ (1. fc) = 0;

Proposition

Wc have the matricial products: .,_!,.. =2-,_1,t, fl,ι_lΛ nd α^T^-E.^^ with:

2,_ll-t(A,j) = 1; 3>,_1,tγ(/,fc) = xt,_lΛ(j);

2f,--

1,t,(

fc.j)

1-fj>H

1{fc<''}

1lo<--}

+ («., _!,-,(-.) -«t._ι,t, )) i{fc>j}i{i<fc}i{--<o};

J.+1

+- '^_1,*I(/ + 2)--r,,_lΛ(/ + l)' for all I + 1< fc < 0 ; 1 < fc < h - 1

^+1 2 .( = x -ι,tΛk + 1) - it.-i.t i") a:t--ιΛ rø - xt,^.ι,tt(k - !) r/r-1 r.fr .._!,.,(&+ lj - »-,-!,-, (fc) xt,-ι,Xk) - τU- Xk - 1) '

+ ■

^-.-l... (0) - z-,_ι,., (-1) a.i.-ι,t. (1) - •T-.-i.i, (0) ξ-1 3

Z-.-i,. - (°) _ (-1) xt,-ι,t, (!) - τ. ,-ι,*, (°) '

-Bi,_.,i,(l) ---t,_1,t,(0) --*,_.,-, (2) --Ci,_lA(l) δ° δ) + rr1 τ^τ + ■ '

'£-.,_!,., (1) - ~r-t ,_. ,f, (0) xt ,_.,*, (1) - a. f ,_.,/, (0) '

S.--1

'*,--,.. (ft-i-Λ = - ».,_-,-, h - 1) ~ *t,-ι,*, (A - 2) 'r ^,_. ,i, (A) - -Ci,_. ,/-, (A - 1)

.1-2

+ - s-._-,.. (ft -1) i --*.._-,-, (A -2)'

-i _ ^_1 Tt'-lΛ(Λ,j) " ^,_lA(A)-^,_lΛ(A-l); with (5". = 1 if n = rn, and δ^' = 0 for any other value of n.

Multi-dimensional Case

Wc indicc T and its inverse to the basis instruments considered and apply it m times to obtain the basis instruments or the states prices of the desired dimension. The components of B and Pa in the representation above are m-l dimensional matrices.

Writing the compression algorithm:

To obtain Pt(n — 1), a simple transform may help by decomposing in the basis instruments and treating the case of moments or baskets separately.

After that, based on the assumption that the Pt(ι) may be analytic in the dependent variables, make polynomial interpolation by arcs and selecting the next points based on a condition being met (for examples on the derivatives at the previous point).

3.1.2 Correspondence between EOFBICP format and EADBICP format

Let's set (Ω, F,p) the probability space.

Ω,t = {So, Si, ...,S„_ι} Lot's call X the random variable with values in P. The characteristic function of X is defined as : x(z) = Ε(e" )

Let's obtain all the state probabilities form the determination of Φx . To do that, wc simple assign to z. itcratively the values 0.2τr....,2(n~ l)π an wc obtain:

Φ^(2τr) = E(e

2lπX) -=poe

2Mr ° +PιcX

πSi + ... + p„_ic

2"

r'

s"-

1 Φχ(2(rι - l)τr) = E(e

2m(-"-

1)x) =

PoX "-

1^ +p

1β

2l7r("-

1'

Sl + ... +p

n→e

2lπ<-

,l~

1)s'^

Where we can note:

EI=MP (17)

And wc can recognize in M a Vandermondc Matrix. For a matrix M, we note MJ its coeflicent of line u and row .;, so wc have here : Mυv = e2W(u-i)S„_i_

As wc note M λ the inverse of M, we want to obtain M l so:

P = M→ΈX

A simple method of solution of (17) is closely related to Lagrangc's polynomial interpolation formula.

Let Pυ(x), .. e [0, π— 1], be the polynomial of degree n — 1 defined by:

-2«S„ p ax)= n β2-τrS„ _ e2-τr-5, Y Λ,+ι,A-a.' ι--=0,.i^(J &=-l

Wc can define with the coefficients ofthe interpolation Am , k e [l.n],rn e [l,n] a square matrix A of dimension 'ri.

Wc have ,,(β

2-

S") = δ

uυ =

= ∑' A

v+1,

kM

k>u+1 for -u and υ in [0, n - 1]. Since δ

m, = -5,

ι+ι

]υ+ι we can replace u + 1 and u + 1 by ?i and . in [1, ri\: a

__ AVlkMιU = 5UΏ k=l

This says exactly that A = M~x . Therefore, the solution of (17) is just P = -4E so wc have:

Application to numerical, computation

A simple algorithm to solve the problem is given in [31]: for k=0:n-2 for u=n-l:k+l p(u)=p(u)-exp(2i\pi S [u-1] ) .p(u-l) end end for k=n-2:0 for u=k+l:n-l p(u)=p(u)/( exp(2i\pi S[u-l])-exp(S[u-k-2]) ) end

for u=k:n-2 p(u)=p(u)-p(u+l) end end

This algortithnis requires 5n2/2 flops. An implementation of the algorithm that yields P can be found in Mathematical recipes in C, Second Edition [55] :

#include "i-rutil.h" void vander (double M [] , double p [] , double EX [] , int n)

Solves the Vandermonde linear system. Input consists of the vectors M[l..n] and EX[l..n]; the vector p[l..n] is output.

int i,j,k; double b,s,t,xx; double *c;

c=dvector (l,a); if (n = 1) p[l]=EX[i]; else { for (i=l;i<=n;i++) c[i]=0.0; Initialize array. cCn] = -M[l]; Coefficients of the master polynomial for (i=2;i<=n;i++) { are found by recursion. xx = -x[i] ; for (j=(n+l-i);j<=(n-l. ;j++) c[j] += xx*c[j +1] cCα] += xx; > for (i=l;i<=m;i++) { Each sub ctor in turn xx=M[i] ; t=b=1.0; s=EX[n] ; for (k=n;k>=2;k — ) { is synthetically divided, b=c [k] +xx*b ; s += EX[k-l]*b; matrix-multiplied by the right-hand side, t=xx*t+b; } p[i]=s/t; and supplied with a denominator. > > free_dvector(c,l,n) ;

int n; dimension of the matrix double* M,EX,p; M=dvector(--,n) ; coefficient of the Vandermonde Matrix EX=dve ct or ( 1 , n) ; input of Laplace values

M [u] =exp (2i\pι S [u-1] ) ;

EX[u =ValueOf E[exp(2i\pi (u-l)X] ; p [u]=0.0; } vander(M,EX,p,n) ; computation of the probabilities .

Regular space distribution of states

If wc suppose that the Sk arc regular distributed, for example: Sk — So + fcΔ. Wc have for the coefficient of our Vandermondc matrix:

M _ ,.2J7r(u-l)S„--i _ „2i7τ(---l)-5o„2i7r(.i-l)(u-l)Δ

If wc define D = diag(l, e

2MrSo . ..., e

l7r("-

1)S(>) so that D

u o =

And let's have the square matrix W defined by W

uυ =

ω ("-

i)("-

i) with ω = e

2m . Wc have:

W ■■

The u-th row and v-th colimm term of the product of D and W is given by:

So wc have M = DW . If wc take further the unit step Δ as Δ = 1 so that ω is a n-root of unity let's note W its conjugate. Let's compute the term (WW)„V of row u and column υ of the product of these two matrix : n

(ww)vu = ∑wukWk0 fe=ι

= Σ< .(t--l)(/. - -l1) _(J, -1)(--1) - 1/ω fr=ι

1X^X11 = 0 if u ≠ ,; a-3 (ω"-'u)n --- (<-/')"~",' = l

M-1 = -WD-1 n with -9-1 -= diag(l, er2™Sa, ..., β-2^'"-1)5").

That gives a way to compute the state-prices p0, -pn-ι in only n2 operation. But we can see that the matrix _1 that is obtained is the matrix of the Fourier Transform of order n that means that using a Fast Fourier Transform Algorithm, we can compute the product:

P = M-IΦ -= - ■ TΪ7Y7- ---.---l1 ;-?) n in only 0(n log(τι)) operations.

If wc have a distribution of S non-rcgurlarly spaced where wc write A = Sk — So but that verify the following property:

Vfc e [0, rι - 1], Δfc e Q Let's set Dk e and Nk e N such as A -= ^. Let's set N = lcmjι-e[o,n_ι](iVj.) where 1cm is the least common multiple.

Then we can introduce a regular division (Sfc)fce[c),-v-ι] that fits all the states Sk and wc can apply the previous result as we know how to compute the missing values of the characteristic fimction at any point.

3.2 Incorporation of offer and demand sensitivities in the pricing, risk management and trading of derivatives contracts

A preferred embodiment of the present invention solves one issue that must be addressed in the determination of basis instruments price. The problem is that basis instruments prices fluctuations in response to offer and demand sensitivities must be such that no arbitrage opportimity is created. This is tested by making sure that state prices are positive and the sum of implied probabilities of all states is one.

Although in the definition above the scaling density fimction is defined in an explicit form, in many practical applications, to take into account the non arbitrage requirement the scaling density function will bo formulated in an implied manner. It is an embodiment of the present invention to achieve this by introducing what wc define below as weighting functions

Implied Definition: Weighting Functions Definitions

Lot's define a discrete probability space E = (Ω, B, P) with Ω = 1, , n; we define a weighting function defined on Ω x 5ft™ as W(i, rif) such that:

W(i, n,i) Pi ~ -

∑ W(i, rn)

with W(i, rii) > 0 and ∑ W(i, nϊ) > 0 to prevent negative or infinite probabilities that would create arbitrage oppor- i=l timitics.

Examples of Weighting Functions

To introduce this example wc first establish the following proposition:

Pr oposition :

W define thet axg et robabilities (p,M)1<,<„ andtha bas . robabilities of the marrket m (pf )κ,<rt for the state space under consideratioi with associated notional numbers rι',nsυch that for each i. p"L = —f

Σ

There, exists a sequence of numbers w"' . such that for each i.p '1 = and for any given ualυe of ∑ _-;"' , tha w'" are uniquely determined, for eachi

Proof :

Thus for example, in a market where a first set of state priccs ;^ for any first mit of Arrow Dcbrcu security is postulated, a weighting function may be defined as

to reflect the fact that after state prices react ot state price responsive to offer and demand in a manner similar to the distribution of payouts in a parimutuel game.

In a preferred embodiment of the present invention, weighting functions may be used to simply define scaling density functions of basis instruments by first transforming the input weighting fimctions into conditional state-prices vector and then, using after multiplication by a matrix T, the vector of basis instruments prices responsive to inventory, offer and demand for each basis instrument.

3.3 Incorporation of credit risk in the pricing, risk management and trading of derivatives contracts

Another embodiment of the present invention is its ability to include most accurately credit risk sensitivities in the pricing risk management and trading of financial derivatives.

Credit risk in this setting is the risk that a Counterparty may not honor their financial commitments in full on due date and at due time.

A coimtcrparty to a derivatives transaction typically assumes the risk that its counterparty will go bankrupt or not be able to meet its obligations at agreed upon times during the life of the derivatives contract

Margin requirements, credit monitoring, and other contractual devices, which may be costly, arc customarily employed to manage derivatives and insurance counterparty credit risk In contrast to US Pat No 6,317,727 Bl, US and US Pat No 6,321,212 Bl in a preferred embodiment of the present invention, for pricing and hedging purposes, credit risk in derivatives transactions is reeogmzed as a multiplying underlying whose value m the default free reference currency and coimtcrparty may fluctuate between 0 and 1, this has the benefit of not only facilitating addressing the concern of other methodologies but better still, enable derivatives trading on said credit risks

More specifically, to take this notion into account, for each contract between two parties Ω and β , wo define the stochastic variable S & [0 1] as the percentage of a unit notional liability of N to β that counterparty Ω meets at time t

In the context presented here, ' can simply be viewed as a new imderlymg so that a commitment of β is accurately understood as risk free units of underlying S{ ' So, by multiplying the payoff f of any derivative contract by and by defining its scaling density function, the credit risk of the transaction is automatically included

So a market will fully price credit risk for all types of payoffs if basis instruments for all stochastic variables S ' trade for all β and Ω A reduction in the number of necessary variables could be achieved by introducing a default free referential counterparty ref that would be the opposite side m all transactions, in this setting, the variables of interest would be f with ref fixed, or simply St with an indexation of β such that β e {0, , rn)

sfl X1 follows a beta di tribution with den sity

/-«-.--) β *-> (

X) ---

< x <

X β « .)

(,) ,-- o

. / M > l whore β is the classical Beta Fimction In a preferred embodiment of the present invention, the beta family has the additional advantage of easily computed π — l . . moments so that the moment generating function of /"' ( r) i MGf

a h (n, a, b) = fj X^X and as a result calibration of the credit risk model is facilitated on a variety of input data types s

β In an embodiment of the present invention, the ratios 'j

"1 may be taken to be independent from one another, the

'. beta distribution may depend upon the realized value of other inputs, where said other inputs may include different undcrlymgs

In yet another embodiment of the present invention the credit risk limit of a given counterparty can inferred by setting a maximu-tn responsive to the difference between the value of the counterparty liability not inclusive of credit risk and the value of said liability inclusive of credit risk

4 General Contracts Definitions

Wc define as ό' . ,. (/)2 a so-called derivative security representing a contract entered into at time t0 and paying / Si , ■ ■ ■ , S{' ■ - ■ , S1 ■ ■ ■ , S/'A units of underlying currency Sc at time tn in exchange for the payment of a premium at time i,. This more general definition includes but is not limited to the one in FAS 133 pp3-7, paragraph 6- 11 and its 10(b) amendment in FAS 138. A derivatives contract defined with its payout payment function in the / ( i 1, • • • , S \ • • • , S ■ ■ ■ , S, ) format is called a Derivatives Contract Without Optional Features or DCWOF.

Wc note: IP (/) (Si; • • • ; Sn) = f (~?ι ; • • • i Sn) the price at time tn of the security contract entered into at time to and guaranteeing receipt of / (Sα; • • • ; S„) ≡ / (Sj, • • • , Sf, • • • , S1 • • • , S,'[L) units of underlying currency Sc at time tn. 11^ i ti (/) is the trivially associated contract.

For any i > 0 , wc define as ug t „ (/) (S ; - - - ; S,.) the price at time tt of the sccmity contract entered into at time to and guaranteeing receipt of / (S\, - ■ ■ , S{' ■ ■ ■ . S* • • • . S"1) units of underlying currency Sc at time tn; IIQ^ .. (/) is the associated contract.

For any i > 0 , we define as ϋfj -. (/) (Si; • • • ; S.) the price at time t,, of the security contract entered into at time to and guaranteeing receipt of Uό' ,+1 (/) (Si; ■ • • ; St+ι) units of underlying currency SL at time tt+1; ϋj . (/) is the associated contract.

4.1 Common Examples

A few examples show how some well-known derivative contracts arc translated into this formal functional process:

Vanilla Option, / (S0; • • • ; S„) = (δ(S„ - K ))+

Double Barrier Option, f (So; ■ ■ ■ ; Sn) = (δ(Sn - K))+ 1{ <S,> <H} X • ■ • X l{i<Sι<iϊ}

As- Option, f (S„; • • • ; S„) = (δ( ( ∑ k ) - ) "

Volatility Swap, f (So; - ■ ■ ; Srl) = J ^1 ∑ [^] ∑ ^ l - Kυ fr=ι V

5 Theorem of Decomposition in Basis Securities

5.1 Derivation

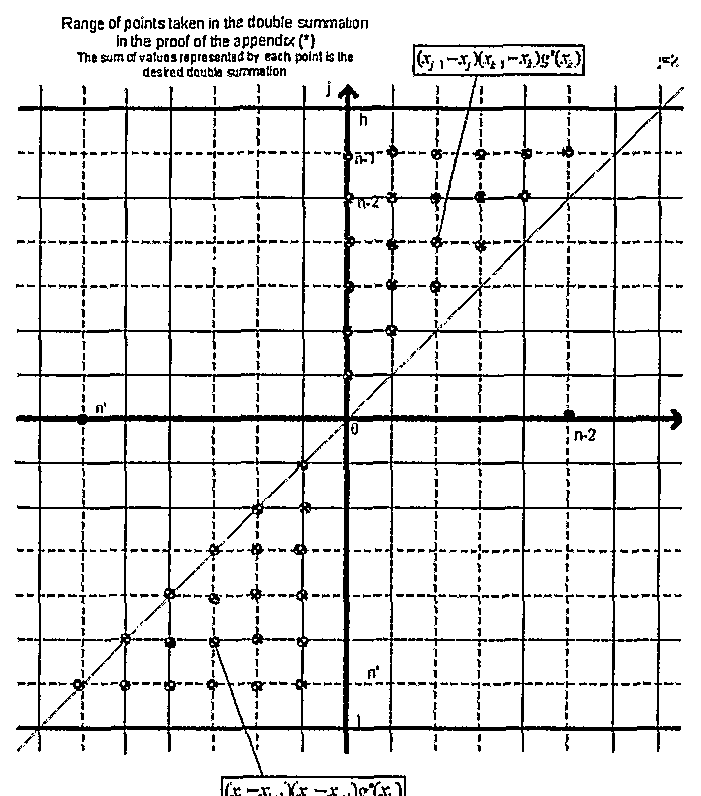

Wc have the following result further detailed in appendix and valid under the notational assumptions earlier introduced for any function g of 3 :

Theorem: For any function g defined on a discrete space of real numbers Ix, with J -= 7 ι x ■ • • x J m an m-dimcnsional discrete space so that J , = { — oo < x\ < ■ - ■ < a.n < • • • < x < +00} . With the discrete definitions of derivatives and T is more generdl definition includes but is not limited to the one in FAS 133 pp3-7, paragraph 6-11 <-Jid its 10(b) amendment in FAS

138.

3 See demonstration in appendix

integrals earlier introduced, the following formula holds:

- .O =

0<

/ι<. < Σ)p< q ∑—0χi)

q+p <k < Σ .<k

(1<m '

χ" "

/ (Sgn(t- -sϊ)(x» - *ϊ))+ •• (SflnfV* - ?)^- -tf)) + f x θ?.ι -^d,^ JFg (si, .., i'V, i ..,-.?)*'1"*"- and with Sgn(x) = 1 if a; > 0 otherwise Sgn(x) — —1

Thus, replacing ø by up , (/) (SO; ' ' • i £») above and using our definition of basis instruments, with β being the buyer and Ω the seller, wc deduce that, for i > 0,

Proceeding recursively backwards from πjj t (/) (Si; • • • ; S„) = f (S^; ■ ■ ■ ; S„) , wc obtain π0' n (/) and can deduce o that πjj n (/) (Si;---; Sn) = ∑ Iϊ(j , (/) (S ; • ■ • ; Si) The theorem of static replication of derivative securities from t=n— 1 primitive securities thus follows as:

5.2 Theorem 1 of decomposition (Static Replication) of derivatives

Assuming no arbitrage opportunities exist, any derivative security --Ij , „ (/) representing a contract entered into at time to and paying / ( j , • • • , S \ ■ • • , Si ■ ■ ■ , S'') at time tn for a premium paid at time tt can be decomposed as a sum of basis securities as:

And wc also have: ---gA„ (/) (S0; ■ • • ; -?,) = D-g,, (/) (S0; ■ ■ • ; -?,) With: --x - . x

---dt"-

At the end of each trading period, the sum of all debit positions is exactly equal to the sum of all credit positions. With positions automatically netted, this means any derivative security would be statically replicated with the selected basis

4The equivalence bet een absence of arbitrage and equivalent martingale measure is not assumed in this presentation because the possible existence of slippage effects and its implications for the non lineal ity of trading strategies break the proof of the result as detailed in [3 ],[35]. As a result, the whole martingale approach is not used in this presentation.

securities

The first components in formula (18) are what wc call zeroth order basis instruments on the basis currency and arc or extend what is known as zero coupon bonds m a single future period case