The House Financial Services Committee held a hearing Tuesday on the collapse of cryptocurrency exchange FTX following the Monday night arrest of founder Sam Bankman-Fried in the Bahamas as U.S. regulators released a slew of civil and criminal charges against the one-time billionaire.

The Justice Department and Bahamian authorities said Bankman-Fried, who was previously scheduled to testify before the panel, was arrested based on an indictment in the U.S. that was unsealed shortly after the hearing started.

The U.S. Attorneys Office for the Southern District of New York charged the disgraced crypto executive with eight criminal counts: conspiracy to commit wire fraud and securities fraud, individual charges of securities fraud and wire fraud, money laundering and conspiracy to avoid campaign finance regulations.

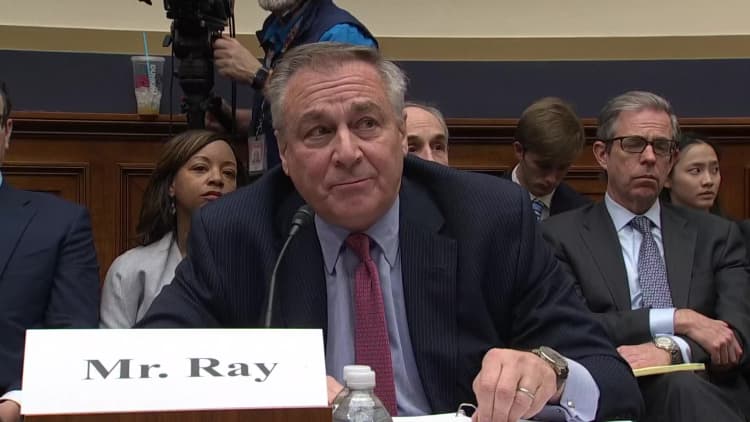

John J. Ray, the company's new CEO and the panel's sole witness, told lawmakers the company had "no record-keeping whatsoever," using bookkeeping software QuickBooks to track its multibillion dollar portfolio.

"This is really just old fashioned embezzlement. This is just taking money from customers and using it for your own purpose. Not sophisticated at all," Ray said in blistering testimony that lasted more than four hours. "Sophisticated, perhaps in the way they are hiding something, frankly, right in front of their eyes. This is just plain old embezzlement. Old school, old school."

The company imploded and filed for Chapter 11 bankruptcy last month after reportedly transferring billions of dollars in FTX customer funds to Bankman-Fried's hedge fund, Alameda Research.

The Securities and Exchange Commission also charged the former crypto "darling" Tuesday morning with allegedly "orchestrating a scheme to defraud equity investors in FTX Trading," according to the agency.

The Senate Banking Committee had also asked Bankman-Fried to testify at a Wednesday hearing that he previously refused to attend.

Prior to his company's implosion, Bankman-Fried donated almost $40 million to candidates, campaigns and political action committees in the 2022 congressional midterm elections, with most of his publicly disclosed contributions going toward Democrats. Ryan Salame, the co-CEO of FTX Digital Markets, donated another $23 million, with the majority of his contributions heading toward Republicans.